vermont sales tax rate 2021

Register for Vermont Sales Tax. Thursday May 5 2022.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

2021 Vermont will require marketplace facilitators to collect the Universal Service.

. The major sales taxes sales and use meals and rooms and purchase and use. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. With local taxes the.

This is the total of state county and city sales tax rates. 2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. A recent bureaucratic report recommends expanding Vermonts sales tax to include food groceries electricity and clothing.

The state sales tax rate in Vermont is 6. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. Local Sales Tax Rate a.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. The state sales tax rate in Vermont is 6. The sales tax rate is 6.

The Burlington sales tax rate is. 2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Tax rates are provided by Avalara and updated monthly.

295 rows Vermont Sales Tax. Did South Dakota v. Vehicle Classification 6 9 Maximum.

March 1 2021. Change Date Tax Jurisdiction Sales Tax Change Cities. The County sales tax rate is.

On this home the home buyer would pay 05 of 100000 which would come to 500. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. In total the buyer would be responsible for paying 2675 in Vermont.

Graham Campbell Senior Fiscal Analyst Joint Fiscal Office. History Fun Facts. 2021 Vermont Tax Expenditure Report.

Vermont Use Tax is imposed on the buyer at the same rate as the sales taxIf you are a new business go toGetting Started withSales and Use Taxto learn the basics of Vermont Sales and Use Tax. Each states tax code is a multifaceted system with many moving parts and Vermont is no exception. Meanwhile total state and local sales taxes range from 6 to 7.

Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. The range of total sales tax rates within the state of Vermont is between 6 and 7. No committee of conference report found for S53 in the Regular Session 2021-2022.

Meanwhile total state and local sales taxes range from 6 to 7. Sales tax rates remote seller nexus rules tax holidays amnesty programs and legislative updates. Alternative business taxes bank franchise and insurance premiums property taxes and transportation excise taxes gasoline and diesel fuel.

S53 - An act relating to exempting feminine hygiene products from the Vermont Sales and Use Tax. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent.

Look up 2021 sales tax rates for Strafford Vermont and surrounding areas. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Over the past year there have been one local sales tax rate changes in Vermont.

The minimum combined 2022 sales tax rate for Burlington Vermont is. 2021 Vermont State Tax Tables. Vermont wants sales taxes for groceries.

A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals. If the tax paid on an out-of-state registered vehicle was equal to or more than the Vermont tax rate no additional tax will be due. Wayfair Inc affect Vermont.

Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates. Vermont Sales Tax Rate Look-Up. Local jurisdictions can impose additional sales taxes of 1.

2020 Vermont State Tax Tables. Find sales and use tax information for Vermont. State State Sales Tax Rate Rank Avg.

Meaning you should be charging everyone in your state the rate where the item is being delivered. Use tax is also collected on the consumption use or storage of goods in Vermont if sales tax was not paid on the purchase of. 31 rows The state sales tax rate in Vermont is 6000.

For other states see our list of nationwide sales tax rate changes. The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. Average Sales Tax With Local.

What is the sales tax rate in Burlington Vermont. 2021 Vermont State Salary Examples. As of January 1 2021.

This represents the majority of the States annual tax revenue. Vermont is a destination-based sales tax state. The Vermont sales tax rate is currently.

6 Vermont Sales Tax Schedule 9 Vermont Meals Rooms Tax Schedule Alcoholic Beverage Tax Local Option Alcoholic Beverage Tax Local Option Meals and Rooms Tax Location Option Sales Tax Vermont Percentage Method Withholding Tables for wages paid in 2020 Interest Rate Summary 2022 Interest Rates Memo. Vermonts tax system ranks 43rd overall on our 2022 State Business Tax Climate Index. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Then the second 150000 would be taxed at 145 which comes to 2175. Exemptions to the Vermont sales tax will vary by state. Credit will be given for the purchase and use or sales tax paid on this vehicle to another jurisdiction.

How Is Tax Liability Calculated Common Tax Questions Answered

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

The Most And Least Tax Friendly Us States

States With Highest And Lowest Sales Tax Rates

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Income Tax Vt State Tax Calculator Community Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Definition What Is A Sales Tax Tax Edu

Publications Department Of Taxes

When Did Your State Adopt Its Sales Tax Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Vermont Property Tax Rates Nancy Jenkins Real Estate

Sales Tax By State Is Saas Taxable Taxjar

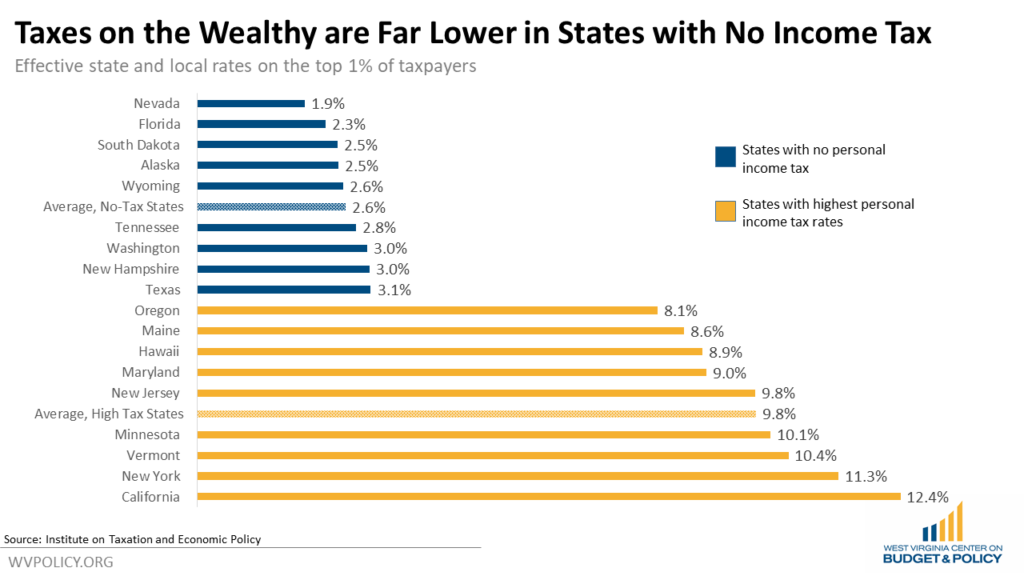

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy